ECS Full Form

Full Form of ECS- Electronic Clearing Service

ECS refers to electronic clearing services.

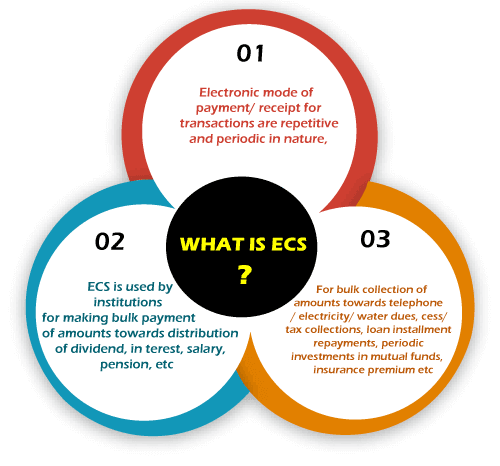

ECS is a scheme of electronic mode. It helps in transferring funds from one bank account to another. This scheme permits electronic transactions, including credit or debit, and is connected to the accounts of the user or customer. This scheme is used for all kinds of transactions, including periodical or regular. It is used at the time of bill payments like payment of the gas bill, electricity bill, payment of salary, etc. ECS was introduced in India by Reserve Bank of India to facilitate quick payments.

How get the ECS scheme?

- The client needs to inform the bank for setting up for ECS payment with his/ her account.

- Then the bank provides the customer the form that is necessary to fill.

- It works as permission or proof that the user has allowed the bank to make payments- credit as well as debit.

- The form requires filling of necessary details like – bank account details, bank branch details, etc.

- The form asks to mention the maximum amount that the bank is allowed to debit from the customer’s account, along with the purpose of debiting the money and setting the validity period for every deduction.

- The customer receives the SMS or the email alert when the amount will be debited from the customer’s account.

Types of Electronic Clearing Service

There are two types of ECS;

ECS Credit and ECS debit

ECS credit – This scheme implies the bank makes credit to a certain bank account or account of the customer. This type of account is mainly used to initiate or make payments, including that of salary, dividends, etc. This account is debited many times to make payments to several accounts.- mostly implies to the account of the organisation or institution.

ECS debit- This scheme implies when a single or individual account is used to make payments, including Loans, EMI, mutual fund, etc.

Advantages of ECS

There are several benefits of ECS, including;

- ECS helps in enhancing customer relationships

- ECS also aids in reducing the usage of paper

- ECS does not impose late or delayed payment charges

- ECS is quite helpful and beneficial in making quick and easy payments of the bills

- ECS makes payments of essential utility bills easy, effortless and quick. These include payment of electricity bills, phone bills, payment of internet bills, etc.

- Electronic Clearance Scheme also helps in payment of premium of insurance, loan instalments, credit card payments, payment for mutual funds, and so on.

- ECS helps in achieving customer satisfaction.

- Processing and Service Charges of ECS

- ECS service or scheme is free of cost for the customer.

- As per the rules and direction of RBI, the bank cannot impose any charges or fees on the customer for the ECS transactions.

However, charges may imply for certain participating banks. As per the RBI directions and rules, banks need to pay a normal or minimum charge of 25 paise and 50 paise on the basis of a per transaction when the cost or charges are debited. Whereas the bank or the cost is getting credited has to pay nominal charges of 25 paise and 50 paise per transaction as per the RBI rules.

How to discontinue with ECS Scheme or Mode

To stop an ECS, the customer has to inform the beneficiaries and the banks about the payments that too well in time or in advance by a written application.

It is pertinent to note that the ECS transactions will portray in the account of the customer as per the information or conditions given by the customer. This will be in consideration with the payments, dates, and other crucial information.

It is essential to keep a tap on the bank statements on a regular basis to stay updated about the same. Also, it will help in being sure that there is no lack of coordination or mismatching between the information given by the customer and the payment deducted from the account of respective customer.

Important Points to Remember;

ECS completely removes the need for issuance of the cheque or even usage of an online payment gateway for regular payments like EMI, so it is essential to make sure that the account has sufficient funds for the clearance of the ECS.

If there are insufficient funds and ECS bounces, then the customer is most likely to pay for the penalty charges.

2. ECS

ECS- Environmental Control System.

ECS is also the short form for Environmental Control System. This is used mainly in the aviation industry. This refers to providing air for the ventilation, controlling of the temperature or pressure of the cabin- for the passengers as well as the crew.