Full Form of ATM

Full-Form of ATM

In today’s techno-driven world, you can easily take cash out from your nearby ATM. But many of you still do not know what does ATM stands for?

An ATM stands for Automatic Teller Machine.

This tutorial will briefly learn about the definition, types, functions, and other detailed information about the ATM.

Topics Covered:

- Definition of ATM

- History of ATM

- Types of ATM

- Part of ATM

- Working Principle of ATM

- Functions of ATMs

- Advantages of ATMs

- Requires Specifications to use an ATM

- Using ATMs Abroad

- ATM Owners

Definition of ATM

“ATM or Automatic Teller Machine or cash machine is an electro-mechanical device containing programmed banking applications. It permits the customers to perform financial transactions (unlike cash inquiry, withdrawal of cash, account information, bill payments and account-to-account fund transfers) at any time without the need of any bank official by inserting a bank card. ”

ATMs are advantageous, enabling the customers to carry secure and fast transactions on their own. Anyone who has a debit card or credit card can easily withdraw money at most ATMs. Today, almost every Bank provides ATM cards (usually debit card or credit cards) to its customers. Every bank has its ATM either inside or outside of their branches. ATMs are also placed in heavy traffic zones such as highways, bus stands, central markets, railway stations, malls, petrol pumps, airports, society, club, shopping or grocery stores, restaurants, and other locations.

ATMs are also identified as Automated Bank Machines or ABM or Cash Machines or Money Machines in several parts of the world.

History of ATM

ATM doesn’t have only one inventor and it is the end output of many inventions that are conducted over time. The concept of ATM turned up in 1960 when an American named Luther Simijian patented the first ATM as a Bankograph. This Machine could automatically accept cash or checks at any time during banking hours. It wasn’t quite successful because people didn’t trust a machine with their money at that time. Later, in 1966, the cash-dispensing Machine was introduced in Japan, and since then, many versions of ATMs were launched in different parts of the world.

By the early 1970s, ATMs had spread across the globe, and banks in the UK and US signed up to have their Auto-Teller Machines. The banks did massive campaigns and advertising to make their customers comfortable with the ATM. in just a few years, the ATM successfully paved its way all over the globe. As a result, currently, more than 3.5 million ATMs are operating worldwide.

FACT: In India, there are around 2.48 Lakhs active ATM’s spread across its length and breath.

Types of ATM

There are mainly two types of ATMs.

- Primary Model: These ATM models are only capable of dispensing cash and provide updated account balance statements. These basic units are commonly found everywhere and are programmed with fewer applications. ATMs that are found offsite are often designed only for cash withdrawals.

- Complicated Models: The more complicated machines support various bank applications unlike withdrawal of cash, deposit of cash, transfer money, pay bills and access account details. They are expensive, need high maintenance and hence are present at only some particular places. Complicated ATM models are not for the general public and are only operated by bank staff. Hence, most of the ATMs are placed inside or outside the banks are usually multi-functional.

Analysts predict that the number of ATMs will increase at a high rate in the future. With its popularity and growing demand, the technology and application of an ATM will also be upgraded. The future ATMs are expected to be full-service centers.

Parts of ATM

The ATM is secure, reliable and easy to operate. Unlike computers, ATMs also consist of input and output devices for proper functioning and dispensing of cash. The output and input tools of an ATM are as follows:

Input device

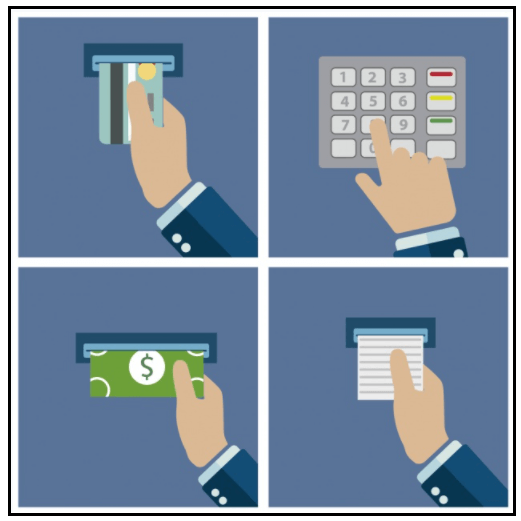

Most of the ATM has two Input devices i.e., Card reader and Keypad.

- Card reader – The card reader input device recognizes the account data deposited in the ATM card's magnetic strips. Once the account holder inserts the ATM card, the card reader immediately collects the details and directs them to the ATM server in the card slot. When everything is validated, the cash dispenser permits the cash to be dispensed based on account information.

- Keypad - Keypad assists the user with the mandatory information required from the machine, unlike the type of account, PIN code, personal ID number, cash amount, whether the receipt is needed or not and other information.

Note: The PIN code is always fetched from the Keypad in an encrypted form and is sent further to the server.

Output Devices

The output devices mandatory for the smooth functioning of an ATM are speaker, display screen, receipt printer and cash dispenser.

- Speaker – Whenever we press any button, a kind of audio pops out or sometimes a voice dictates the various specifications. This is because a speaker is attached to the machine responsible for generating the audio whenever it receives input.

- Display Screen- The display screen is responsible for presenting all the information on the screen involved in the transaction process. It directs the steps for dispensing the cash withdrawal or to fetch the statement. The Display screen can be of CRT or LCD.

- Receipt Printer-Almost all the ATMs support the transaction printed receipt facility. Hence, a printer is required to print the account details (balance amount, withdrawal amount, date of transactions) on the receipt paper.

- Cash Dispenser- The Cash dispenser device is a vital tool responsible for dispensing the ATM cash. Highly reliable sensors are fitted in the ATM to regulate the cash dispenser's flow of appropriate cash.

Working Principle of ATM

The account holder needs to insert his debit cards inside the ATM card slot to start the process. Though different ATMs have different mechanisms, as in some ATMs, you have to drop your cards in the card slot while in others, you only need to swipe it. The ATM cards have a magnetic stripe that contains all the necessary details regarding your bank account. Whenever you place the card in the card reader, the ATM receives all the security information related to your account and validates the account holder by asking the user to enter the PIN code. Once the authentication is validated, the ATM will sanction the transactions.

Functions OF ATMs

The various functions of ATMs are listed below:

- To dispense cash

- In certain ATMs, cash can also be deposited.

- Generating or changing the PIN (Personal Identification Number) code

- Transfer of cash

- Accounts details

- Fetch Mini account statement

- Payment of the bill

- Carry out other function unlike linking of Aadhar Card number to the bank account

- Fetching bank account balance details

- Recharge of prepaid mobile

Advantages of ATMs

- ATMs are secure, fast, reliable, efficient and easy to use.

- ATM service is available for 24 x 7, and they can withdraw their cash at any time from any ATM and the clients do not have to wait in long queues to dispense their cash from their account.

- The ATM card allotted by one bank can be used by any other ATM within a country using the SPNS (Shared Payment Network System).

- It supports efficient customer support as the clients can file their complaint in the bank if they face any deficiency in ATM services.

- It reduces the workload on bank officials.

Using ATMs Abroad

Nobody likes to travel with a bag full of cash, and why need it when you have ATMs. Foreign ATMs make it easy and secure for travelers to access their bank accounts anywhere around the globe.

Travel experts recommend using foreign ATMs as a cash source while traveling. The travelers will get a more competitive exchange rate than they would receive from the currency exchange agencies.

However, it may charge the account holder's bank some amount as transaction fee service. Most ATMs do not list the exchange rate on the receipt, making it difficult to track spending.

ATM Owners

In many cases, the ATMs are owned and operated by banks and credit unions. They use ATMs as an advertising medium to attract more clients. However, certain ATMs are owned and operated by a third party. Individuals or businesses may also buy or lease ATMs on their own or through an ATM franchise. They are usually non-banking finance companies, unlike gas station owners or shopping store proprietors, where the profit model is based on charging fees to the machine's users.

Requires Specifications to use an ATM

- The Account holder must have a plastic ATM card, i.e., a debit card or a credit card.

- The ATM cards come with a magnetic chip that is responsible for transmitting the data to the machine. Ensure that the magnetic chip is in good condition as the card has not expired as and is valid until some specific date.

- A PIN authenticates consumers to validate and complete the transaction.