Full Form of IMF

IMF (International Monetary Fund)

The International Monetary Fund (I.M.F.) is an organization located in Washington, D.C. It consists of "189 countries trying to cultivate global fiscal cooperation, secure solidity involving money, promote universal exchange, promote high business and useful economic deepening, and reduce the global need." "Established essentially by the ideas of Harry Dexter White and John Maynard Keynes at the Bretton Woods in 1944, it happened to come into the structured existence in 1945 with 29 member states and the goal of replicating the national platform of installments. In the current situation, it assumes a vital role in managing the equilibrium of the difficulties of payments and worldwide money-related crises. Through a component structure where the nations facing parity of payment issues can get cash, countries can potentially boost a pool.

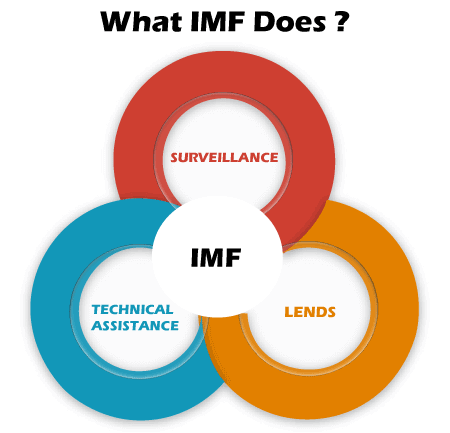

In 2012, the fund mission covered both the financial market and macroeconomic problems impacting regional peace. The I.M.F. is currently playing a crucial role in handling the balance of payments and the global financial crisis. Via a quota scheme where the countries facing balance of payments issues will make payments, nations allocate funds to a pool. The fund had SDR 477 billion (about $667 billion) as of 2016. The I.M.F. works to develop its member nations' economy through the Bank, other programs, and the need for a specific policy.

I.M.F. History:

A significant milestone in the development of international monetary cooperation is the founding of the International Financial Institutions.

Commercial competition grew amongst the world's largest nations after the First World War. Great fear and misunderstanding triggered the collapse of the national currency. Under the 1936 Tripartite Deal, the United States, England and France attempted to develop trade peace, but it also collapsed during the Second World War era.

The biggest nations have once again attempted to revert to the gold standard. These countries also required, under the gold standard, to increase their sales and to minimize inputs. A few nations have resorted to currencies deflation to accomplish these targets.

Thus, in many of the nations, there was near destruction and destruction throughout that time. Currency rates have continued to fluctuate, negatively affecting the currency.

At the end of World War II, there was a desperate need for a financial entity. The British put forth a 'Keynes Proposal' plan, whereas the United States put forward the next 'White Plan' plan. At Bretton-wood, a conference took place.

Participants in this meeting were members of 44 nations. As a response, in December 1945, the World Bank came into being to foster global economic prosperity by maintaining the National Governments' sustainable development.

The International Monetary Fund began operations on 1 March 1947. The I.M.F. helped to grow national governments' foreign liquidity to make the trade balance more beneficial. Thus, the fund is a pool of currency reserves and banking systems, under which some terms are made accessible to the Financing Participant.

To circumvent all trade barriers and hindrances will further facilitate service account. The fund is thus the most intentional effort at coordinating the operation of international monetary relations.

I.M.F. goals:

In compliance with the second edition, the Association of the following are the principal objectives of the I.M.F.:

1. Financial Co-operation on Financial Affairs:

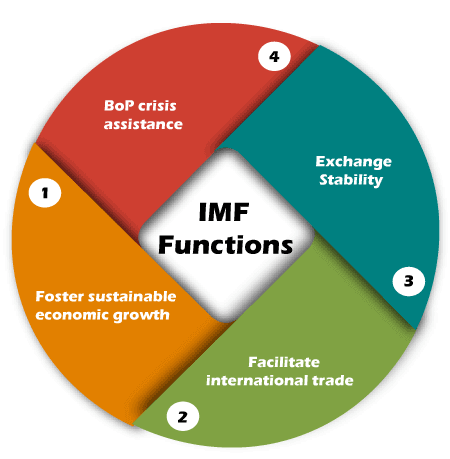

The Company's financial primary objective was to develop monetary coordination among the different member countries. The I.M.F supports machinery for consulting and cooperation on global economic problems. During the Second War, the I.M.F. played an essential role in fostering monetary solidarity between countries worldwide.

2. To Foster Peace in Exchange:

Significant uncertainty persisted in various nations' foreign exchange markets that had negatively impacted international trading before the Second World War. Therefore, the I.M.F.'s goal is to foster markets' stability and prevent the harmful effects of the deflation on exchange rates.

3. Exchange Access Elimination:

A critical aim of the I.M.F. is to abolish foreign currency restrictions. Every other nation has set the rate of exchange at a certain amount during times of war. Global commerce has been negatively affected by this. Therefore, by boosting foreign trade, it is necessary to eliminate control and over the gold prices.

4. Intergovernmental Exchange and Transaction Institution:

The I.M.F.'s goal was to develop and replace the old bilateral trade with an intergovernmental trading and payment mechanism by lifting exchange barriers, which would hinder the development of peaceful trade ties in world trade.

5. Global Trade Development:

By eliminating all the barriers and delays that have unfairly created constraints, the I.M.F. helps facilitate foreign trade. In this way, it grants a significant role in accelerating foreign exchange development by ensuring stability in the balance of payments.

6. Larger Job and Income Generation:

With substantial trade policy initiatives and structured productivity expansion, the I.M.F. is helping to expand trade. It, in turn, generates jobs and revenue.

7. Credibility Development:

The goal is for the I.M.F. to build confidence among the Member States by ensuring adequate monetary assistance to rescue them at the moment of every recession. It will have an incentive for them to correct the current account deficit imbalance.

8. Emergency Relief:

The fund can provide its member states with short-term monetary assistance during all sorts of disasters.

The membership:

As mentioned below, the trust has two groups of representatives:

(1) Original Founders

(2) Regular Participants.

The fund's initial representatives refer to all those nations whose delegates participated in the Bretton Woods Conference and decided to be representatives of a Fund before 31 December 1945. Both those who eventually be a participant of it are considered ordinary participants.

After serving reasonable notice in writing to a particular effect, any nation can, nevertheless, cease to become its participant. The I.M.F can even revoke the membership in a country that may not conform to its laws. The number of member nations in 1947 was 40 at present, with 180 countries as representatives.

The Fund's Framework and Management:

The fund is an autonomous/affiliated entity of the U.N.O. The fund's control shall be carried out under the Chief Executive's guidance by the Board Members. 21 Managing Officers on the Board of Directors, seven appointed, and 14 existing survivors are elected. The new representatives come from the U.S.A., Germany, the United Kingdom, France, and Canada.

Do we understand what the benefits and drawbacks of global trade are?

- Benefits and drawbacks of international commerce.

- Strong resource assignment position.

- Growth-producing.

- Improves the financial condition of backward nations.

- Normalization leads to efficient prices.

- Reformation in government and communications.

- It increased the life series of goods.

- Export of harmful goods and policies of actionable commerce.