Full Form of CMA

Full Form of CMA

CMA- Credit Monitoring Analysis

CMA is also known as Credit Monitoring Analysis. It is a critical analysis that is done by the credit analyst or a banker to evaluate or assess the credibility of the organisation or the company that has applied for the loan. It includes the in-depth analysis of current as well as the estimated or planned financial statements of the loan application.

The CMA or the analysis portrays the creditworthiness of the company that shows the ability of the organisation to repay the loan or the outstanding amount. CMA is a very important function of the department of finance of the company or the organisation that provides the loan.

The banks or the organisations check or assess the CMA report of the company or the organisation before sanctioning of the loan, and if the report or CMA is not proper or right, the loan may not be approved or sanction.

So, CMA or the Credit Monitoring Arrangement or the Analysis is the financial report that is utilised by the lending firms or the institutions to evaluate, assess or appraise the finances or the financial stand of the company before lending or giving the loan. CMA report or the data is very essential for loans to be approved as well as for the working or proper functioning of the capital limits.

Important Facts To Consider

There are various factors as well as points that are considered for the CMA like the current business of the company, the credit history of the organisation, their current asset, their liabilities, their balance sheets, and they even assess and evaluate the current as well as the future projected or estimated financial statements of the company.

CMA report of the company is also known as the performance analysis of the company or the organisation. They help or assist in analysing the past performance, projections, and more or less the health of the company.

Purpose Of CMA

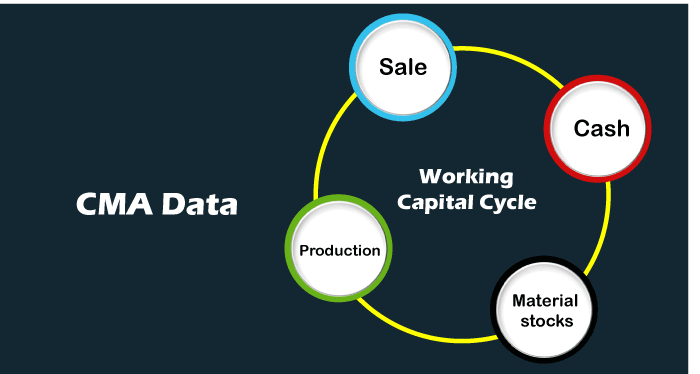

The primary purpose or aim of the CMA is a systematic analysis of the working capital management and to ensure there is an effective and efficient flow of the funds.

- CMA data or report is provided by all the banks, organisations, entities for grant of loans for the aim or the purpose of granting a loan for the expansion of the business and for the enhancement of the credit limit of the organisations or the entities.

- CMA is a very important sector to keep in mind as well as understand by the person that is dealing with the finances of the organisation or the company.

- According to the guidelines of the RBI, data of CMA is essential for future loans, term loans, etc. The Bank assesses the eligibility, rate of interest for providing the funds to the borrower, and it is computed on the basis of CMA data.

- So the detailed report of all the past financial performances of the business, company or the organisation along with the information of the finances of the organisation or the company is analysed and understood by the financial institutes.

- Every data collected is scrutinized- all the inflow and the outflow of the capital are carefully taken note of.

Benefits of the CMA report

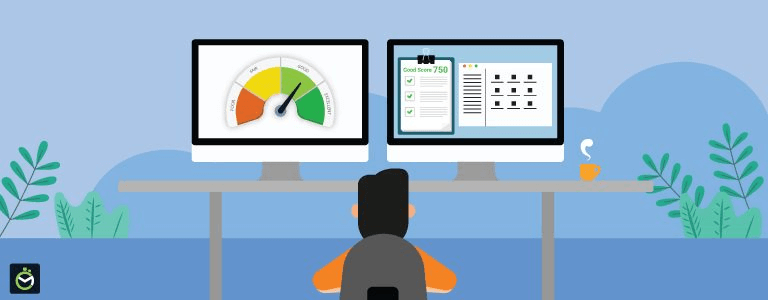

1. CMA reports are helpful in providing the scientific analysis of the current as well as the future profit-generating capability.

2. This CMA report gives a clear picture about the financial situation or health of the borrower through a detailed analysis of the balance sheet.

3. CMA report is also helpful in making the basic or standard key ratio for the evaluation of the company or the business.

4. CMA data or report helps in deciding the creditworthiness of the borrower and also to know that if he or she is easily meeting the requirements of the working capital.

5. CMA report can also help us know the future net worth situation of the borrower for the future years.

Format and Content of the CMA

The structure or the layout of the CMA data is usually fixed, and most often, the CMA data includes the performance of the previous years along with the current year estimates and future five-year estimates.

The content of the CMA includes;

- Profit and Loss Accounts or Statements

- Cash Flow statements which include the inflow of the cash as well as the outflow of the cash.

- Ratio analysis

- Balance sheets that give a broader horizon

- Fund Flow of the Statements

- Evaluation, analysis, and assessment of the maximum bank finances that are permissible.

- So simply, CMA provided the blueprint of the finances of the company or organisation from year to year.

2. CMA – Certified Management Accountant

CMA also refers to the certified management accountant.

CMA is a professional degree or certification that is essential or credential for the management account and the management of the financial field. This particular certification implies that the respective individual has knowledge in the sectors of financial planning, decision, analysis, and controlling of the financial situation.

There are various organisations that offer or provide CMA certification to the candidates. Some of the renowned bodies include;

- Institute of Management Accountants USA;

- Institute of Certified Management Accountants (Australia); and

- Certified Management Accountants of Canada.

CMA is a certification that is global, and the said certification is recognised by the IMA or the Institute of Management Accountants.

CMA is a global qualification, and there are over 50,000 certified management accountants around the world. CMA is an intensive finance-related course, and specialised education or training is imparted to the candidates in sectors like planning of the business, auditing, analysis of the cost, preparation of the budget, etc.

Whereas in India, it is essential to become a member of ICMAI or the Institute of Cost Accountants in India. This was earlier known as the ICWAI or The Institute of Cost and Works Accountants of India.

Course of CMA

The course of CMA includes two components;

- Training and the theoretical section. The theory part includes the CMA foundation, then Intermediate, and then the Final.

- In addition that candidates also go through rigorous training in communication, soft skills, computer training, industry-oriented training, and some practical training.

Eligibility

The essential criteria that are necessary to be fulfilled for CMA includes;

- The candidate should have successfully completed the 12th class from a recognised board.

- This makes the applicant eligible for the Foundation Exam, but if the candidate has completed their graduation, then he or she can directly be eligible for the intermediate course.

- Then the candidate can pursue their initial training and appear for the intermediate exam, and once successfully passing the exam, can go ahead with the final course.

- After completion of the course and passing the final exam, he or she can become a member of the Institute.

Fees

The fees of the said course is quite reasonable in comparison to the qualification, privilege, or respect of the certification.

Exams

The examination or certificate is held twice a year.

Post CMA certification;

Every industry or sector needs CMA. They are essentially in high demand in all the areas in public or private.

Some of the most common titles for the CMA include;

Finance Manager, Finance Director, Finance Analyst, Chairman, Managing Director, etc.