full form of PAN

What is the full form of PAN

PAN: Permanent Account Number

PAN is an abbreviated form of Permanent Account Number.

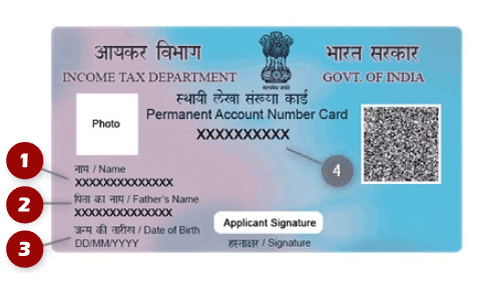

PAN is an identification number that usually consists of ten characters, mainly alphanumeric. The same is issued in the form of a laminated card by the Income Tax Department. The PAN consists of numeric as well as alphanumeric characters. The card mostly has information like name, date of birth, signature, and a photograph. It can be obtained by any individual, after fulfilling the criteria and documents. It is an essential document for filing ITR and also serves as crucial identification proof.

The Pan is a unique identification number that is issued to all judicial entities, and the same can be identified under the Indian Income Tax Act 1961. The PAN number and the card are issued under Section 139 A of the IT Act. It is issued by the Income Tax Department under the administration of CBDT( Central Board for Direct Taxes). It is also issued to investors or foreign national, subject to valid visa, so it cannot be considered as an evidence of Indian citizenship.

Format of PAN

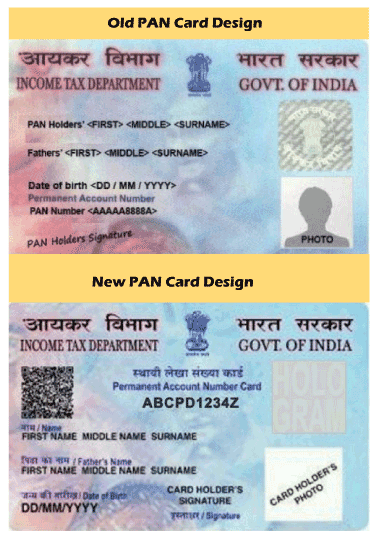

Each PAN card that is issued has a specific format or structure. Each card has information, like name, date of birth, as matching with the KYC. The general format of the card includes;

- Name of the person or Organisation

- Father's Name

- Date of Birth (Registration date in case of an organisation)

- It is Followed by a Signature and also has the photo of the applicant.

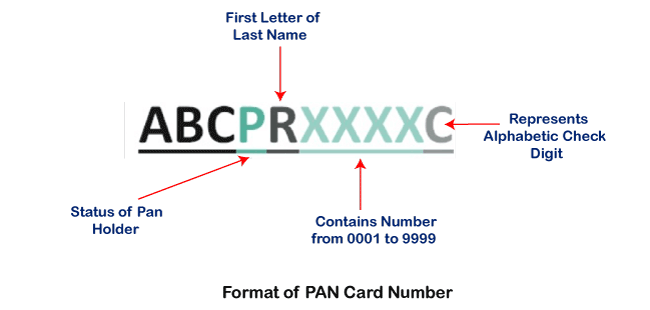

The PAN number that is issued usually has the first five characters as English characters or alphabets, which are followed by four English numerals or numbers, and the tenth character is an alphabet or letter. For example, AABPC4567V.

Now, let’s understand some interesting information and details related to the format;

For example, suppose a PAN card number is given as:

1. the Fourth character of the Pan card is usually the status of the pan cardholder i.e.

P -refers to the Individual

C -refers to the company

H -refers to Hindu Undivided Family

A -refers to Association of Persons

B -refers to Body of Individuals

G -refers to the Government Agency

J -refers to Artificial Judicial Person

L -refers to Local authority

F -refers to Firm or Limited Liability Partnership.

T -is a symbol of Trust.

2. Whereas the Fifth character of a 10-digit number correlates to the first character of the applicant or individual's surname or last name, and in the case of non-individuals, it is the first letter of the name of the pan cardholder name.

3. The 6th to 9th characters of 10 digit pan card number are from 0001-9999

4. The Tenth character of the ten-digit pan card number is the alphabet check digit.

Types of PAN Cards

There are several types of PAN cards that can be issued, including Individual, Trust, HUF, Company or organisation, minor, society, firm, AOP, Artificial Judicial Person.

Essential Documents for PAN Card

There are various documents that help us or serve as identity proofs/address proofs; one such crucial document is a PAN card. Also, there is a list of documents that are necessary while applying for a PAN card or number. These documents are;

1. For Individual Applicants, the requisite documents are voter id, driving license, aadhar card, or passport. Any of these can be submitted while filling the form for pan card or number.

2.In the case of HUF or Hindu Undivided Family, an affidavit of HUF on behalf of members along with the date of birth identity proof and address proof of the members is required.

3. For Companies, a certificate of registration that is issued by the registrar is sufficient.

3.In the case of Trust, a trust deed or certificate number issued by Trust is essential for applying a PAN number.

4. In the case of society- a registered certificate number that the commissioner of cooperative society has issued is required.

5. Lastly, for foreigners, a bank statement of their primary residence country along with the passport and bank statement of the NRE account in India are some of the necessary documents for a Pan card or number.

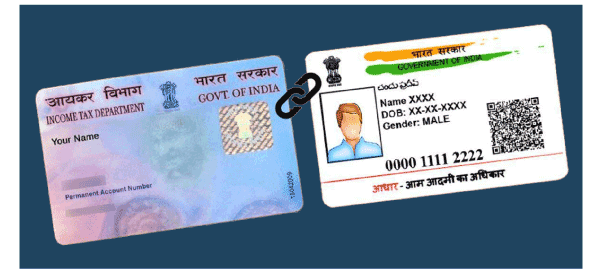

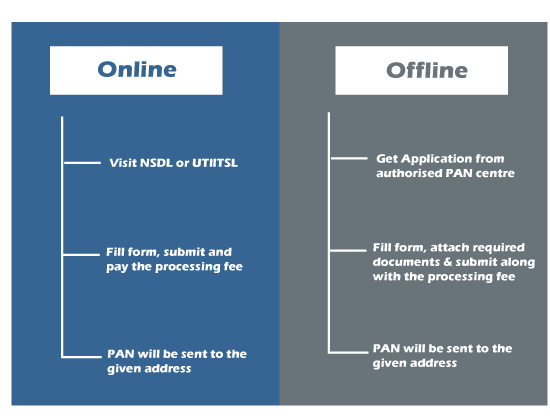

While these are the necessary documents while applying for the PAN card or number, but apart from this, one can apply for the PAN number in the mentioned format along with the essential documents either at the authorized agency of their respective district or even online by submitting essential information and data at NSDL website or UTI. The time period to get the pan card can vary, but mostly it takes around 10-15 days to get the card. To speed up the process, a user with the Aadhaar card can even submit the e-KYC.

Usage of PAN card

Some of the important usage of PAN Card have been listed below:

1. Pan number or card is a pre-requisite for filing an income tax return and also serves as an important identity proof.

2. Pan card is required while opening a bank account or taking a loan or a credit card.

3. Pan is a mandatory document while selling or purchasing a property costing more than five lakhs.

4.Pan number is necessary while purchasing or selling of the vehicles.

5.Pan card also helps to bring universal identity for all the financial transactions and thereby helps to avoid tax evasion by keeping track of all the financial transactions.

6.Pan has also now become essential while depositing more than 50,000 in the bank, also while buying a foreign currency, and much more.

Application Forms for PAN Card

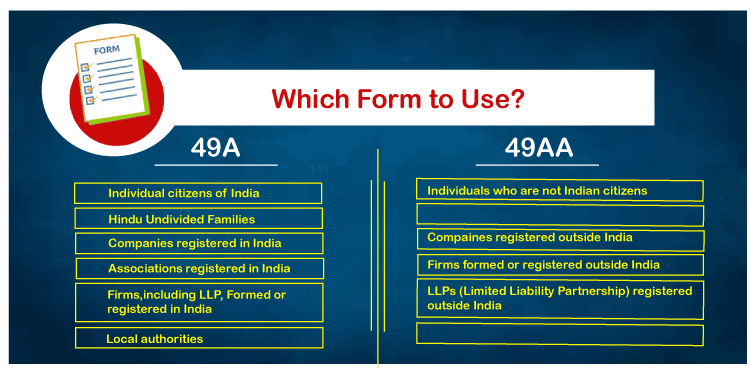

There are two types of PAN application forms including;

- Form Number 49A

This form is for the individuals that have never applied for a PAN card or number and have neither of the two issued to them.

- Form Number 49AA

The Form number 49AA has to be submitted by foreign nationals in case they wish to apply for a new PAN card.

If individuals want to get a new PAN card or want to make some changes or modifications in the one issued to them, then they need to submit their application in the format of " Request for new PAN card or changes or correction in PAN." The form 49A/49AA can be used by Indians and foreign nationals, the form needs to be submitted with the changes required.

Model for Issuing PAN card

The entire procedure of issuing PAN, its verification, and maintenance depends on PPP (Public-private partnership). Its processing is similar to PSK(Passport Seva Kendra).

Renowned agencies like NDSL e-Governance Infrastructure Limited (earlier known as NSDL (National Securities Depository Limited) and UTIITSL (UTI Infrastructure Technology Services Limited) have been given the responsibility by the IT department for the processing and managing the PAN applications.

Procedure for applying PAN Card

With digitization, the process of obtaining a PAN card has become very easy. One can apply for the same using Aadhaar based eSignature at NSDL e-Gov's portal. The NSDL e-Gov center can be found on the TIN website.

All that an individual is required to do is- Complete registration at NSDLe-Gov's website; soon after registration, a token number is issued along with other essential information. The applicant can note all the essential information that can help him log-in later to get the updates and other details.

Once the applicant submit the form and necessary documents, then an eSign is required, which can be done using Aadhar and OTP.

After the e-Sign, individuals can download and keep a copy of the same for their own reference. The applicant also receives an acknowledgment through email at the respective email address.

Allocation of PAN is absolutely free in case it is filled on the basis of Aadhar. It is an easy and digital process that can be completed within minutes, and the individual can get a PAN number in the form of a pdf for the same within 10 minutes. It is true that it holds the same value and importance as a physical OR laminated PAN card.